The journey to homeownership is often seen as a thrilling adventure – from saving for a downpayment to meticulously monitoring credit scores. Looking at homes for weeks or months. Submitting an offer to purchase and successfully negotiating the best terms. Satisfying all your conditions and “firming up” your next home. Finally, the day arrives when […]

Price isn’t everything. A seller considers many parts to an offer to purchase including closing date, deposit, and conditions. Buyers can learn a lot on how to win in the negotiating process.

The LIFE Real Estate Group is proud to be sponsoring a movie night in the park, in partnership with the Findlay Creek Community Association. We will be playing the new Super Mario Bros movie 🙂 ✨ Join us✨📅 August 26th, 2023🕗 8:00pm📍 Diamond Jubilee Park🍿 Snacks for purchase

It’s a new normal (kind of)! We are still a long way off from a balanced market and it looks like there will be some bumps along the way. At the moment we can see that even in the hottest time in the market (spring) we are cooling off, compared to last year. As we […]

The biggest number that sticks out to me as we watch the market, is the number of days on market. This jump from 5 or 6 days, at its lowest, has almost doubled to 11. We can tell you that our sellers are noticing this change. It is not a bad thing, just different, and […]

We hope that you have a great holiday Monday! Take a moment to get outside, enjoy the day and most of all, relax! We are always here for our clients and friends, if you have a question about your home, give us a call. We can help, it’s what we love to do!

The tide is turning. For the first time in a long while, we have begun to see more new listings than new sales. This means we may finally have turned the corner, and Ottawa could be moving back to a more balanced real estate market. While this is encouraging, we still have a long way […]

While the Ottawa market remains strong, we are seeing some unusual shifts in this crazy market. In a market where holding off on offers has become the norm, we have begun to see buyers push back on this strategy causing some sellers to need to adjust their marketing strategy. Fundamentally, we still have an inventory […]

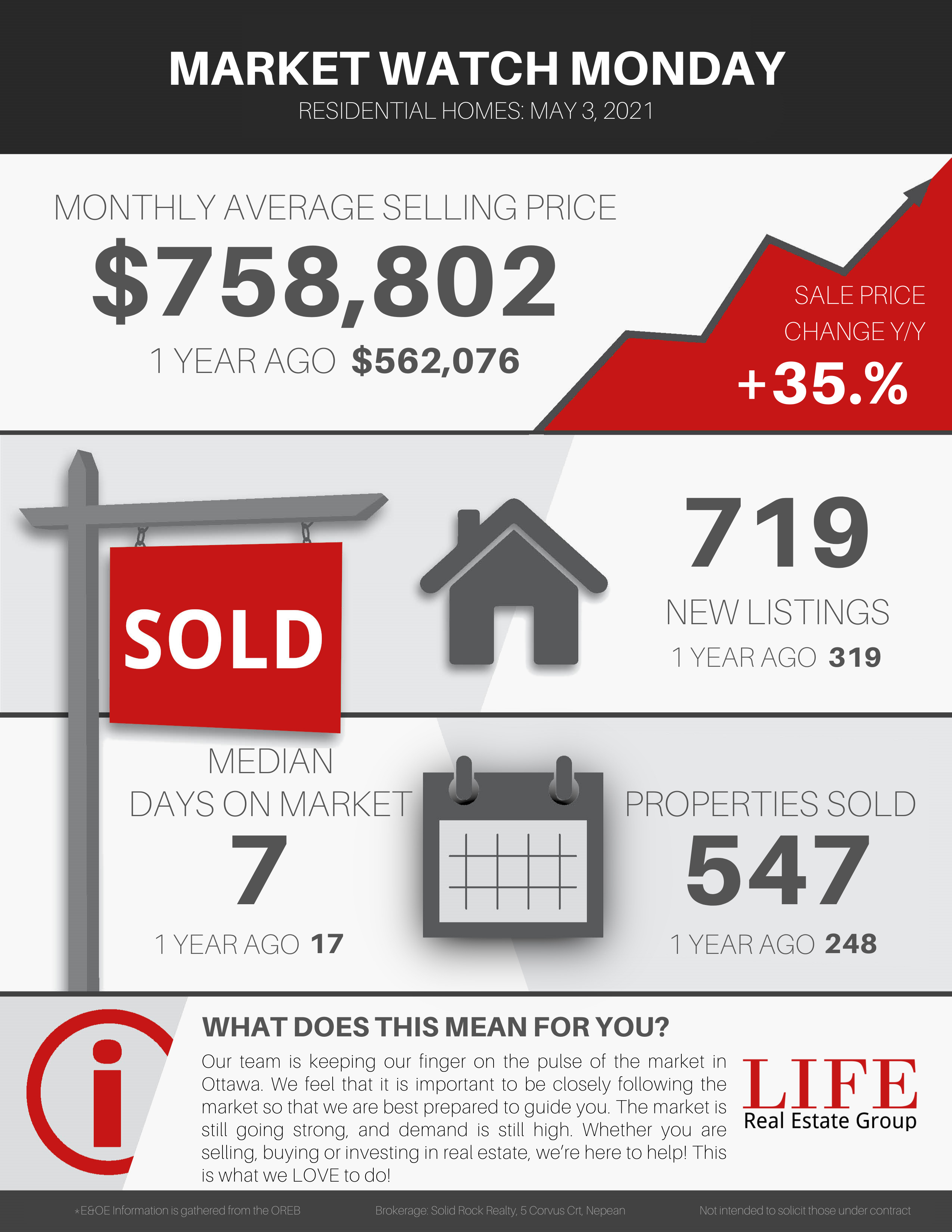

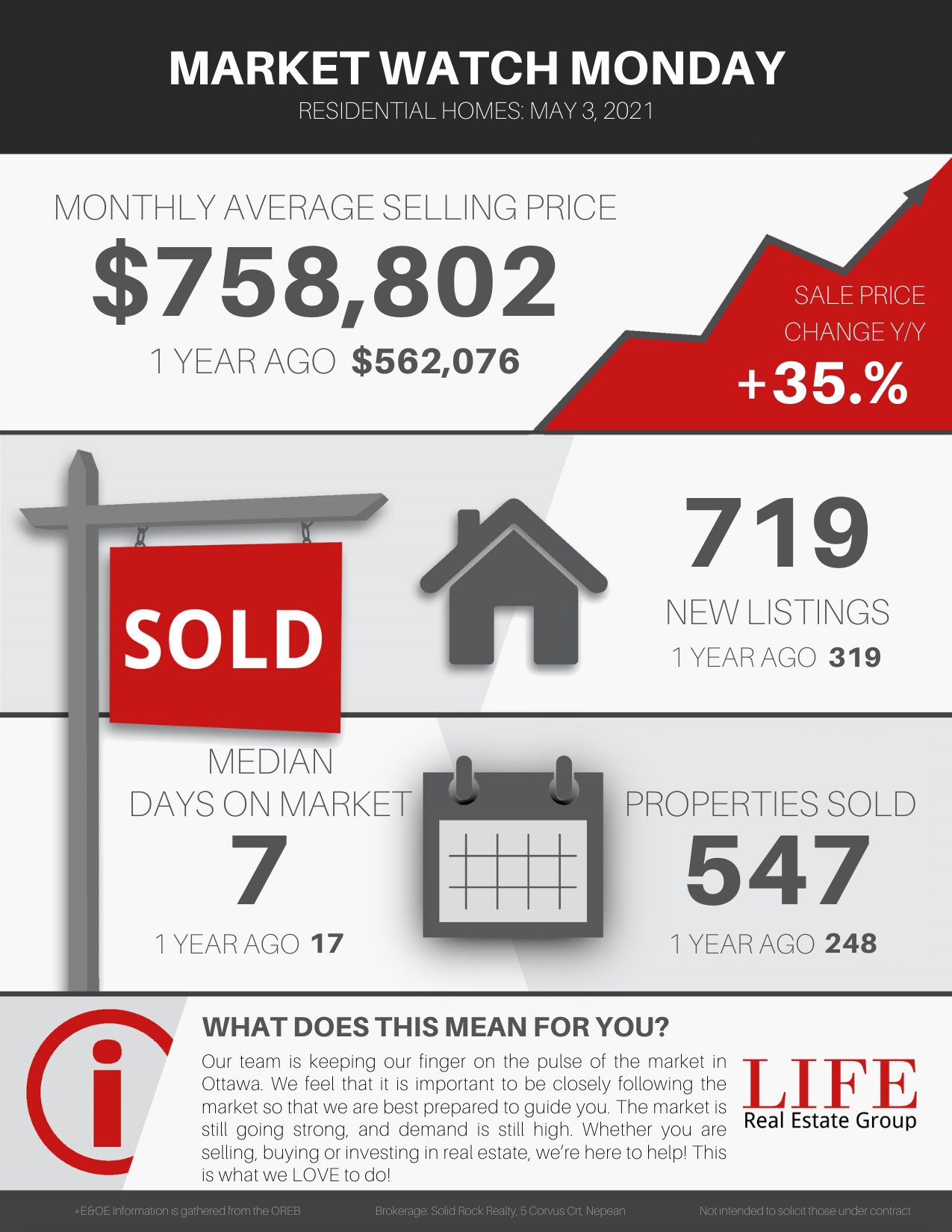

Our team is keeping our finger on the pulse of the market in Ottawa. We feel that it is important to be closely following the market so that we are best prepared to guide you. The market is still going strong, and demand is still high. Whether you are selling, buying or investing in real […]

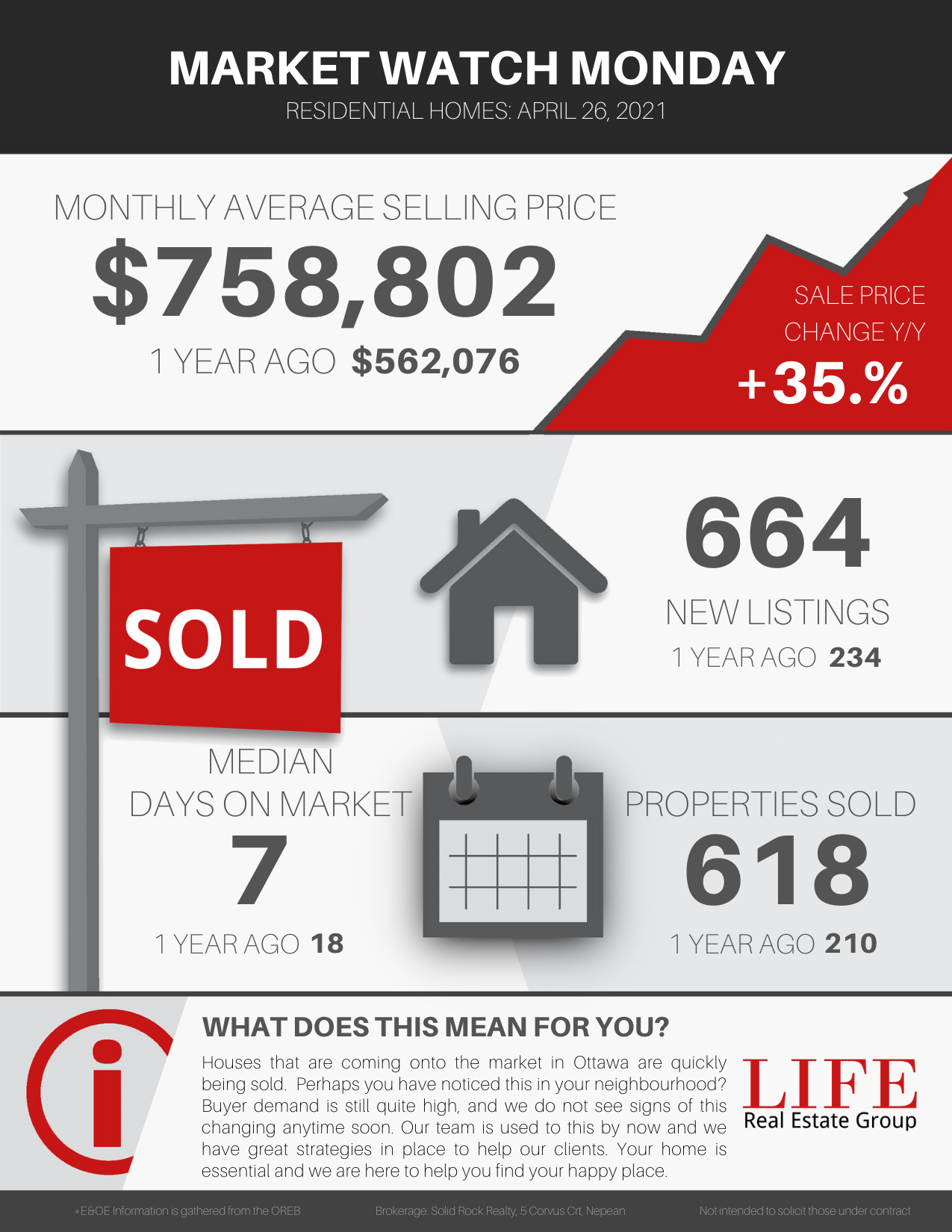

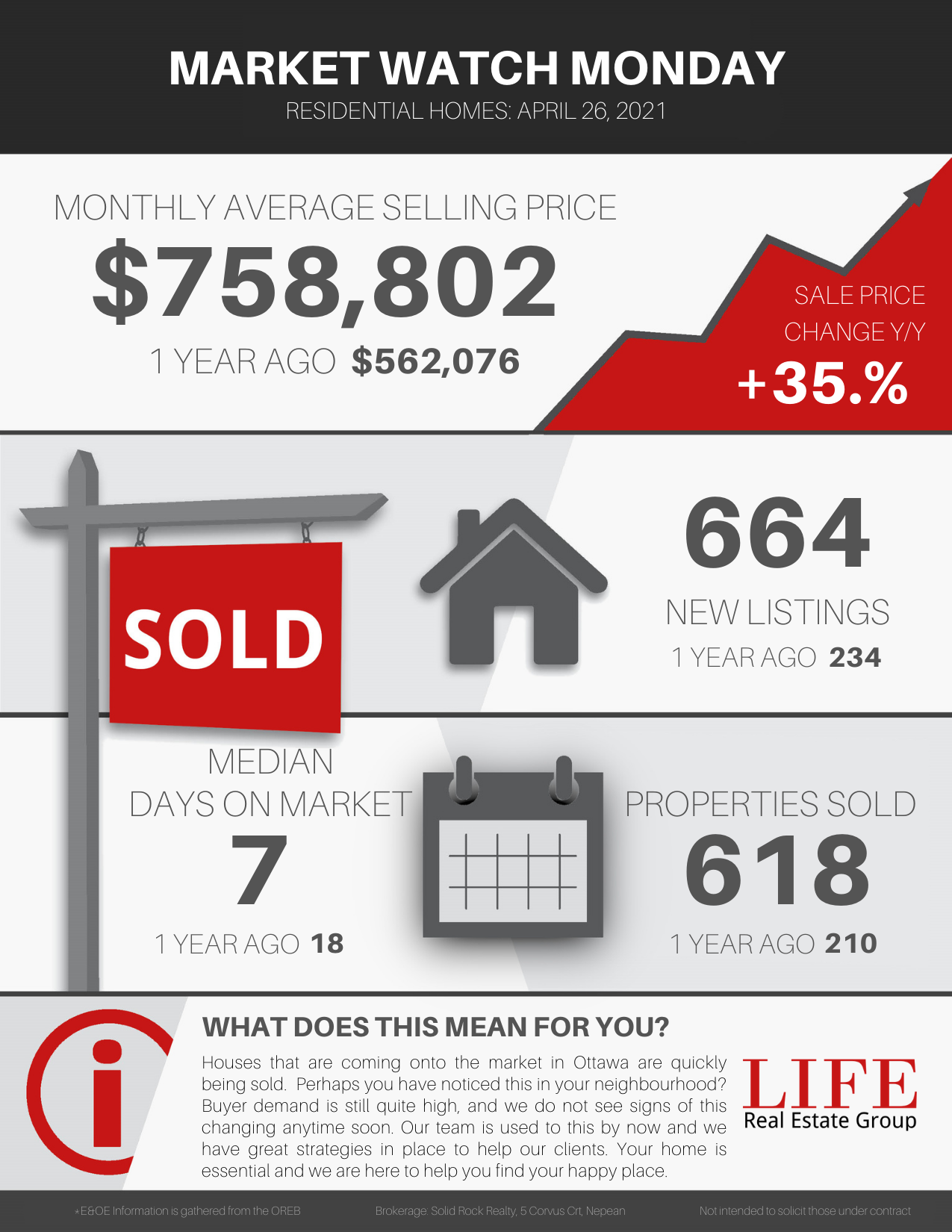

Houses that are coming onto the market in Ottawa are quickly being sold. Perhaps you have noticed this in your neighbourhood? Buyer demand is still quite high, and we do not see signs of this changing anytime soon. Our team is used to this by now and we have great strategies in place to help […]