A lot has happened in the Ottawa Real Estate Market over the past few years. In this article we endeavor to make sense of the events that led us into the current market conditions, and try to look into the clouded future to see what is next to come for Ottawa home buyers and sellers.

Before we can look to the future, it is important to learn from where we have come, and what has lead us to where we stand today. Towards this end, I feel it important to review the relationship between interest rates, inflation, and home prices. We will analyze together what played out with these three metrics over the past 5 years or so.

OTTAWA REAL ESTATE 5 YEAR RECAP

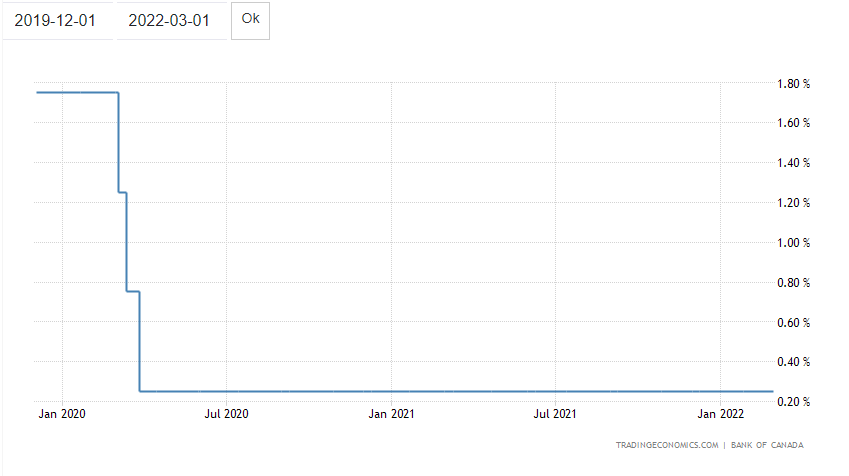

Ottawa home prices soared during Covid, between Dec 2019 to March 2022 the median home price shot up from $350,000 to $611,000, a mind numbing 75% appreciation in only 28 months. During the same time, the Canada Bank Rate fell from an already low 1.75% to a rock bottom 0.25%. This long lasting low interest rate environment meant that buyers could borrow cheap money and have low monthly payments, which made escalading home prices still affordable on the monthly budget.

OTTAWA MEDIAN SALES PRICES – DEC 2019 TO MAR 2022

CANADA BANK RATE– DEC 2019 TO MAR 2022

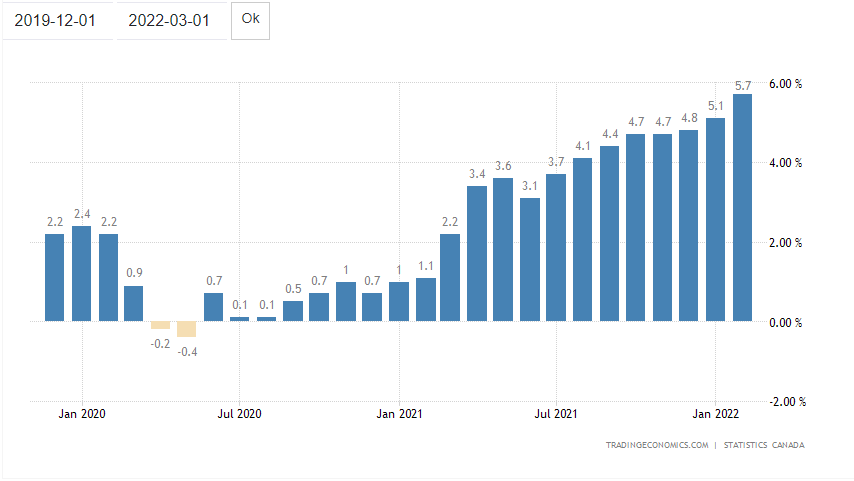

There is a dark side to low interest rates however…any economics 101 class will teach you that there is an inverse relationship between interest rates and inflation. As interest rates go down, inflation will go up…and wowsers did inflation ever go on the rise. Between 2019 and 2022, inflation, as measured by the Canada Consumer Price Index (CPI), increased from an acceptable 2.2% to an economy shifting 5.7%

CANADA CONSUMER PRICE INDEX– DEC 2019 TO MAR 2022

It didn’t stop there either. CPI would go on to hit a high of 8.1% in June 2022. This was felt by Canadians across the nation, and nearly in every industry. From gas prices, groceries, home supplies, and building materials, prices were rising quickly.

It should be stated that a modest level of inflation is actually good for the Canadian Economy. The Bank of Canada explains that “A low, stable and predictable rate of inflation is good for the economy. When people and businesses feel confident that they know what the rate of inflation will be, they can make long-range financial plans.” For this reason, the BoC has a target CPI rate of 2%.

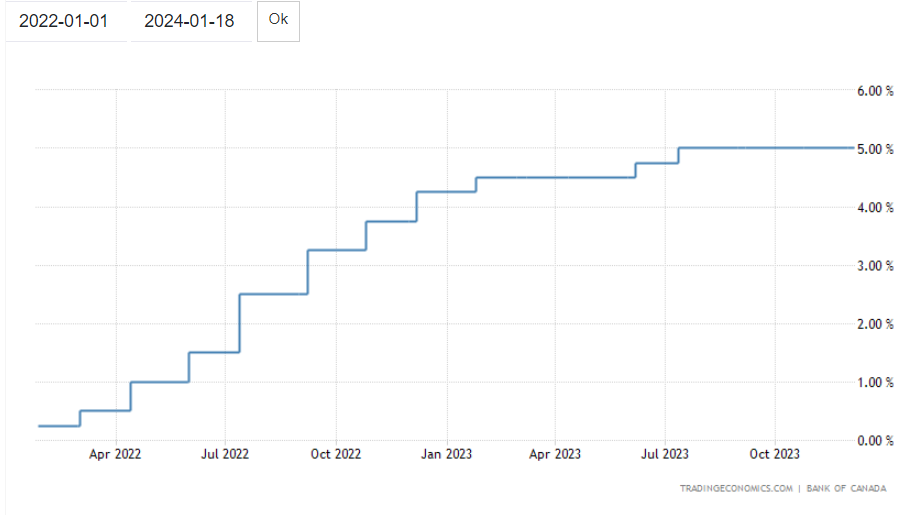

Let’s not forget that this all happened during the pandemic, and everything felt uncertain, not least of which was the economy. It was perhaps because of this global uncertainty that the Bank of Canada was slow to respond to the increasing inflation rate. They delayed taking any meaningful action until it was perhaps a bit too late. It wasn’t until the spring of 2022 that they began with a small interest rate increase. This proved not enough as inflation continued to run rampant. What proceeded over the next year was many subsequent interest rate hikes as the BoC was in full damage control mode and trying to reign in the wildly soaring inflation levels. Over a period of 16 months they adjusted the Canada Bank Rate upwards 10 times. Rates went from 0.25% all the way up to 5.00% where they remain still today.

CANADA BANK RATE– JAN 2022 TO JAN 2024

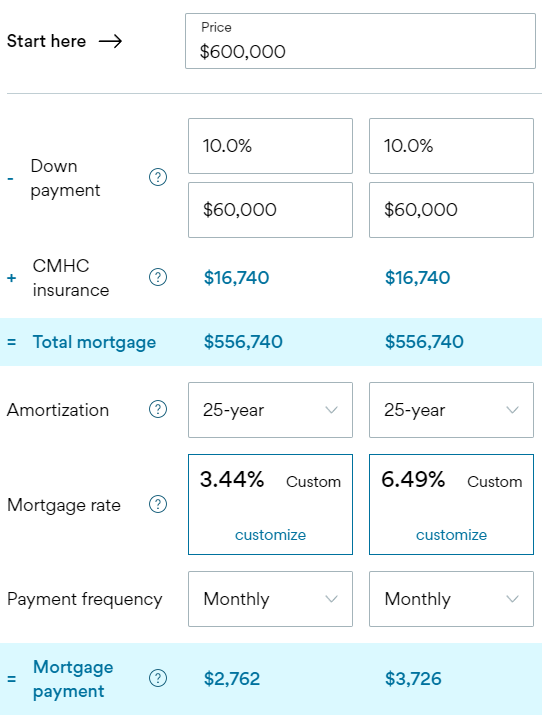

These higher interest rates had an obvious and direct impact on home buyer affordability. Higher interest rates meant higher mortgage payments. As an example early on at the beginning of 2022, buyers could obtain a mortgage rate of approx 3.44%. On a $600,000 purchase, with $60,000 downpayment (10%), the payments would have been $2762. Fast forward only 2 years and interest rates are closer to 6.49%, where payments would be $3726/month. That is an increase of nearly $1000/month!

It is no surprise to us therefore that there would be smaller buyer demand with these interest costs. Lower buyer demand resulted in downward pressure on pricing. Median prices fell from $611,000 in Mar 2022 to today’s median of $420,000.

OTTAWA MEDIAN SALES PRICES – JAN 2022 To JAN 2024

2024 CURRENT MARKET CONDITIONS

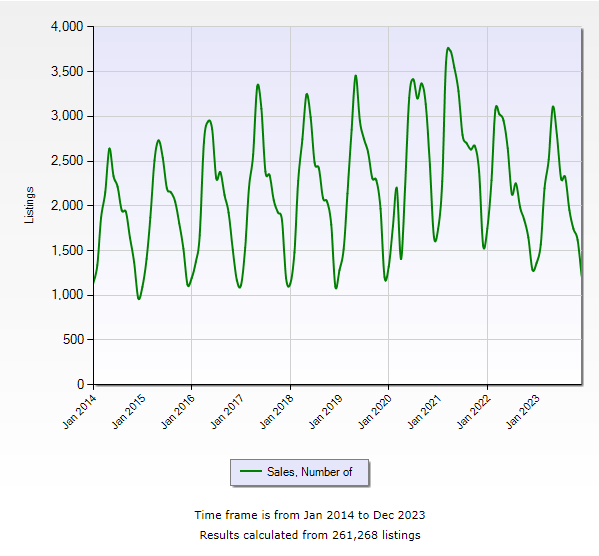

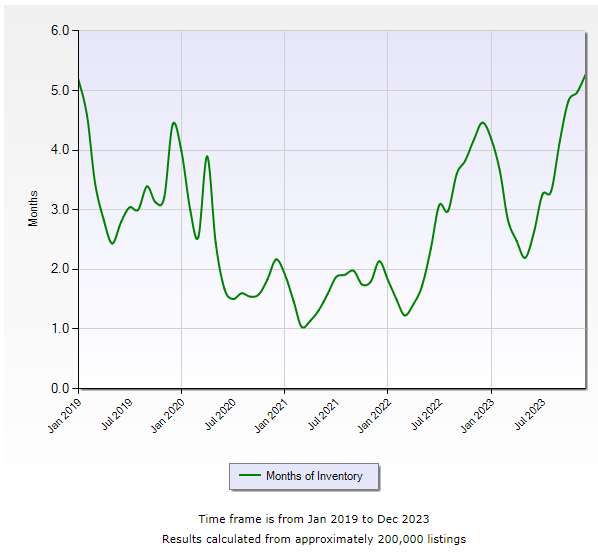

The past 5 years have been a tumultuous market for both sellers and buyers. It created a lot of uncertainty and doubt. Over the past year many consumers took a “wait and see approach.” 2023 was the slowest year in number of units sold in over 10 years. Number of new listings slowly increased and inventory levels have returned to a balanced state of around 3.3 months, an amount we have not seen since 2020.

OTTAWA NUMBER OF UNITS SOLD – JAN 2014 To JAN 2024

OTTAWA HOUSING INVENTORY (IN MONTHS)– JAN 2014 To JAN 2024

OTHER OBSERVATIONS:

- More recently, the month of December 2023 number of sales were up over December 2022.

- Inflation has dramatically cooled off with the current CPI is at 3.4%, although this is still higher than the BoC’s target rate of 2%.

- As of the last BoC interest rate announcement from December 2023, they comment that “Council is still concerned about risks to the outlook for inflation and remains prepared to raise the policy rate further if needed” and adds further “The Bank remains resolute in its commitment to restoring price stability for Canadians.”

2024 Predictions

It’s nice to see Ottawa home prices stabilize a bit, but it is early to conclude that the market has fully turned the corner. It is with cautious optimism that we forecast into 2024. Early indicators suggest that the market is returning to a more balanced market. There is a general optimism from economists and consumers that inflation has nearly finally cooled off and no further interest rates are expected.

TD Economics forecasts that the Bank of Canada will begin cutting rates starting in the second quarter of 2024. They believe that the BoC will hold their Bank Rate steady a bit longer before initiating a series of rate cuts.

Royal LePage published their 2024 Market Survey Forecast in which they have a very similar point of view and they predict Ottawa home prices will appreciate by 4.5% by the end of the year.

The former President of the Ottawa Real Estate Board has also been quoted as saying “we probably won’t return to the peak levels seen in 2022, Ottawa’s market is poised to recover any ground lost in the past year.” If this holds true it would mean an approximate 2-4% appreciation.

One thing we can be near certain of, is that people will always need a place to live. Real estate will always have demand, and it has proven to appreciate in the long term. Provided interest rates don’t go up further, then we believe that the Ottawa market will have a balanced year. We expect higher number of units sold as compared to 2023, and pricing should stabilize further. If the Bank of Canada does decide to lower rates later in the year, we also see some of those sideline buyers return to market and have upward pressure on units sold and median home prices.

Are you thinking of Buying? Are you thinking of Selling? You are invited to connect with us and we can strategize on how you can best take advantage of the current Ottawa real estate market.